Are generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property.

Garage door depreciation life in irs rules.

By stephen fishman j d.

If you do not claim depreciation you are entitled to deduct you must still reduce the basis of the property by the full amount of depreciation allowable.

Are in the same class of property as the residential rental property to which they re attached.

It also provides the effective life of those assets which may be depreciated.

However under new de minimis rules you are able to deduct the entire cost in the year of purchase.

Understand the irs rules on improvements including unit of property betterments versus adaptions and building systems.

Rental property garage door replacement.

Land is not depreciable because it does not wear out.

Taxpayer asserts that the parking structures are land improvements with a 15 year recovery period and 150 declining balance method of depreciation under gds while the irs asserts that the parking structures are buildings with a 39 year recovery period and straight line method of depreciation under gds.

A residential rental building has a useful life of 27 5 years according to the irs.

Depreciation allowable is depreciation you are entitled to deduct.

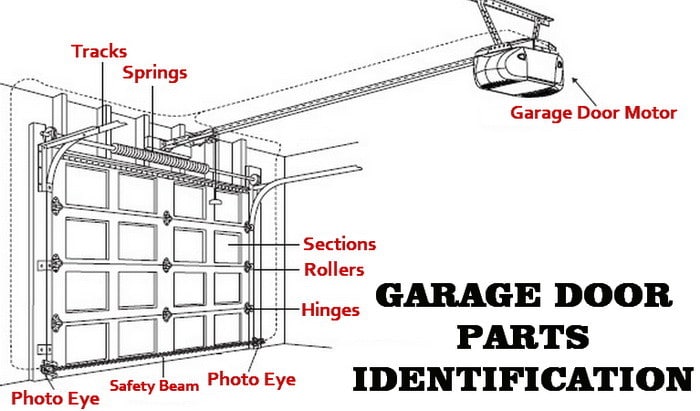

Doors interior and exterior doors regardless of decoration including but not limited to double opening doors overhead doors revolving doors mall entrance security gates roll up or sliding wire mesh or steel grills and gates and door hardware such as doorknobs closers kick plates hinges locks automatic openers etc.

The checklist represents the ato s current views on which assets can be depreciated under division 40 and which assets may be eligible for the building write off under division 43.

I am of the opinion that is a new capital asset and is normally depreciated over 27 5 years.

Depreciation allowed is depreciation you actually deducted from which you received a tax benefit.

Repair expense or capital improvement.

Whenever you fix or replace something in a rental unit or building you need to decide whether the expense is a repair or improvement for tax purposes.

Depreciation for residential rental property assets.

A nonresidential building has a useful life of 39 years.